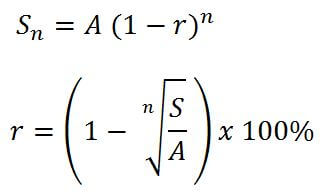

The Formula of Declining Balance Decreasing Method

Information :

A = Cost of assets is the amount of costs incurred by the company to acquire an activation until the asset is ready to be operated.

S = Estimated residual value of the asset is the value of the appraisal that may be obtained through the assets that have passed its life.

r = Depreciation rate or percentage depreciation

n = Age of benefit / Age of economic assets in the year.

D = Depreciation expense for each period

Example Question of Declining Balance Decreasing Method

An asset at a cost of $ 20,000,000. After operating for 6 years is estimated the remaining value of $ 5,000,000. By using the declining balance method determine the rate of depreciation annually!Answer:

A = $20,000,000

S = $5,000,000

n = 6 years

So the amount of depreciation each year is 20.63% of the book value.

Similarly this article.

Sorry if there is a wrong word.

The end of word wassalamualaikum wr. wb

Referensi :

- To'Ali's book math group accounting and sales

Jika ingin bertanya secara privat, Silahkan hubungi no 085709994443 dan untuk berkomentar silahkan klick link di bawah ini 👇

.png)