If the repayment amount is not a multiple of the nominal denomination of the bond, the remaining non-multiplier will be paid in the next annuity.

The way for to calcululate Annuity of Bond Loan

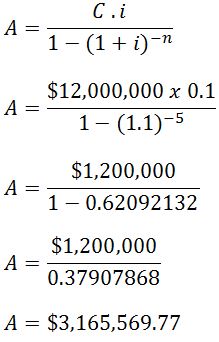

To determine the amount of installment can be calculated in the following way:Example Question of Annuity of Bond Loan

A $ 12,000,000 bond loan split into 1,200 bonds of $ 10,000 each will be repaid on a yearly annuity with an interest rate of 10% / year for 5 years. Please specify the payout plan table!Answer:

C = $ 12,000,000

i = 10% / year = 0.1 / year

n = 5 years

Anuity value

The value of the annuity is:

The repayment plan

The repayment plan is as follows:

Installment table

The installment table is as follows:

Similarly this article.

Sorry if there is a wrong word.

The end of word wassalamualaikum wr. wb

Referensi :

- To'Ali's book math group accounting and sales

Jika ingin bertanya secara privat, Silahkan hubungi no 085709994443 dan untuk berkomentar silahkan klick link di bawah ini 👇

.png)